Family trusts will ultimately reach a point where they need to be revisited due to family circumstances or changes in their financial status. While a trust is a legal arrangement designed to last generations, that does not mean it is meant to remain unchanged or untouched. As family members pass and new family members are born or incorporated into the family business, the trust often needs to be updated. This can be done by examining the timeline of the trust: looking at how and why it was originally established, how it has functioned since then, and what the trust ought to look like in the future.

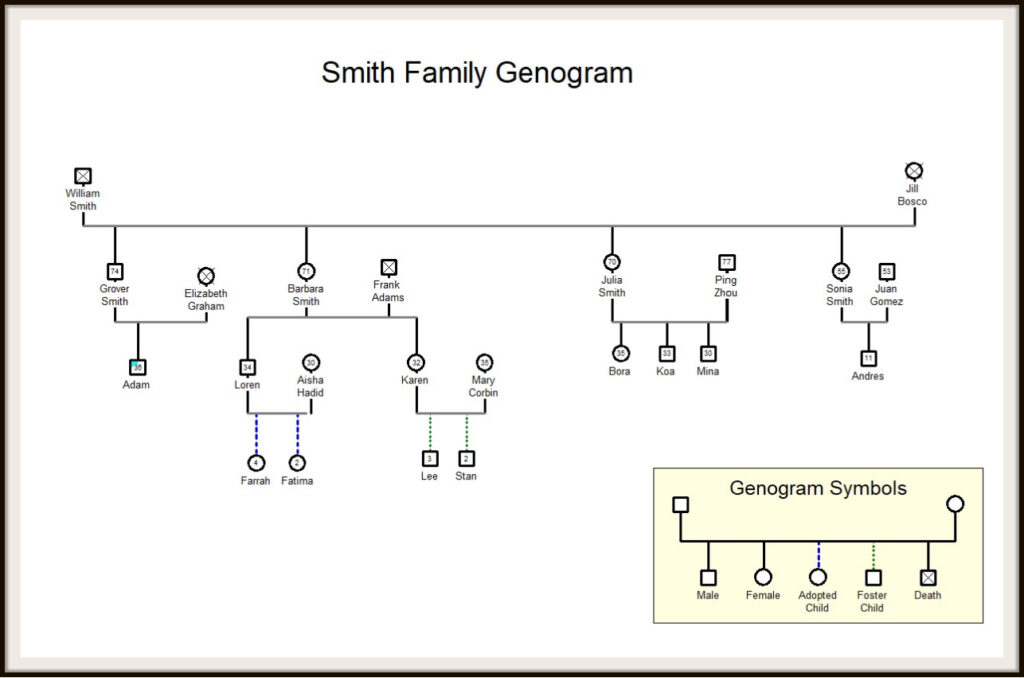

Continuing the story we established in part one, we will now return to the Smith family as they update their family trust. William, the family patriarch, created the first irrevocable trust and appointed Beth, a lawyer with the firm he worked with, to serve as the trustee. William passed away in 2020 at the age of ninety. Now, four years later, William’s eldest son, Grover, is seventy-four and ready to work on selecting a new trustee and trustee advisor.

For the past several decades, Grover has served as the advisor for the trustee, the leader of the businesses, growing the family farm to a substantial business with two packing houses, extensive farming equipment, and a significant investment portfolio with over ten million in investments. Grover’s siblings, Barbara, Julia, and Sonia, have been happy in their roles as beneficiaries, content to let Grover make the decisions and run the business as he saw fit.

However, now the Smith family has grown. Grover, Barbara, Julia, and Sonia have their own children, and this cousin generation is far more varied in their opinions than their parents were. We have more cultures intermingled in the cousin group through marriage, which results in more diverse views on multiple important subjects. These cousins aren’t comfortable simply existing as silent beneficiaries and instead want their voices heard. Some of the cousins (third generation) work in the business, and some do not. They range from 36 to 11 years of age. The oldest, Adam Smith, is autistic and needs a caregiver, who currently is his Aunt Barbara.

With Beth ready to conclude her time as the trustee and with no formal process in place for choosing a new one, the family decides to bring in a family business consultant to help them navigate this process. Their family business consultant, Anna, recommends the beneficiaries begin by creating their criteria and qualifications for their next trustee, something that was never done when Beth first took on the role.

What Makes a Good Trustee?

While the first trustee is chosen by the grantor of the trust, how the next trustee is chosen is usually addressed by a clause inside the trust. Some trusts instruct the current trustee to select the successor trustee. Increasingly, many trusts allow the beneficiaries of a certain adult age to select the successor trustee. This gives the potential to create a much more intentional trustee-beneficiary relationship than the one that was previously in place.

Trusts should have clauses in place that set forth the way new trustees are selected, and we recommend that the current beneficiaries be very involved in this process. They can establish what criteria will make the successor trustee the best steward for the family business or other shared assets.

In the Smith Family, their family business advisor, Anna, helped the family to generate a list of characteristics and qualifications of the ideal successor trustee. As current and future beneficiaries, they were encouraged to ask themselves:

- Should our next trustee have worked in our business/industry?

- Should they have C-Suite experience?

- Should they have served on a board of directors/advisors?

- Should they have been a trustee before?

Anna also encouraged the beneficiaries to consider the balance of power within the family business. Would they want their business’s CEO to also be the trustee? Often, families struggle with having all the power consolidated in one person. If one individual is both CEO and sole trustee, they would have all of the perceived and actual power over the assets that are held for the beneficiaries. While this structure can sometimes come about because there seem to be no other alternatives, it can often lead to the beneficiaries feeling siloed and without a voice. For the Smith family, they knew this was not what they wanted.

Anna also led the family through a conversation on whether or not it was time for the trust to have multiple trustees. For some families, a trust may require multiple trustees to manage its assets, such as an administrative trustee to handle the legal paperwork and a voting trustee to handle the actual representation of the ownership shares. When a trustee is managing an operating business, the grantor, if they’re still alive, and the family can determine whether the trustee is voting the shares on their own or if they will have an advisory board in place within the trust to help them make decisions. They can also determine what the interface between the trustee, the business’s board of directors, and the leadership of the company looks like.

Establishing the criteria for the successor trustee and determining what the family wants the new trustee-beneficiary relationship to look like can be a powerful way to bring a family close together and align them as a family around a legal process. The Smith family determined that they wanted the successor trustee to be an individual with C-suite and board experience who has worked in the farming industry before but not necessarily in their business. The family also agreed that while a successor trustee with previous experience as a trustee would be ideal, it would not be a requirement for candidacy.

Choosing Your Trustee

With the criteria for their successor trustee in place, the Smith family is now ready to begin the process of electing a new trustee. Anna reiterates to the family that the process should be a democratic one, not an authoritative one. It is not up to the loudest or most persuasive family member to choose the new trustee, but up to the beneficiary group as a whole.

When it comes time to vote on the successor trustee, multiple candidates will be put forward from different parties within the family business and the trust. The leadership of the operating business, the current beneficiaries, and the existing trustee will all put forth a candidate, and then the family will vote. With the Smith family’s trust structure, the vote has to be unanimous to pass. In cases where the vote isn’t unanimous, a trust role known as the trust protector can break the vote. While the Smith family did not have this role in place, it thankfully wasn’t necessary, as their vote passed unanimously.

With the successor trustee now chosen, Anna leads the Smith family through some conversations about what it means to be a good beneficiary and how they can go about trusting their new trustee.

| What is the Role of a Trust Protector? This role is defined as a person who is nominated, when the trust is created, to perform administrative and strategic roles not usually assigned to a trustee, beneficiary, or grantor. Trust protectors also help address strategic issues that cannot all be anticipated at the time the trust is created, such as what state the trust should reside in, or help in disagreements between trustees and beneficiaries or between beneficiaries. Trust protectors typically do not act as a fiduciary. |

Being a Good Beneficiary: It’s A Two-Way Street

With the choosing of this new trustee, Anna advised the Smith family to clarify exactly what it means to be a good beneficiary. As we’ve seen, the first iteration of this family trust was more straightforward. The four original beneficiaries have a great relationship with Beth. The sisters were content to sit on the sidelines while their brother instructed Beth on what they wanted from the trust and Grover ran the business. The beneficiary responsibilities weren’t particularly well defined, and beneficiary education wasn’t a primary focus of the family or the trust.

Given the increasing complexity of the Smith family, with them incorporating multiple generations and businesses into the trust, some education around the responsibilities of a beneficiary is necessary. Beneficiaries were encouraged to understand that they have responsibilities to themselves, their family, and the trust itself. A well-educated beneficiary will come to see their trust as a part of their life and their legacy and not simply as a piggy bank. Families can encourage a positive relationship between the beneficiaries and the trust by having the beneficiaries read the trust documents and ensuring that they fully understand the structure of the trust and how it works.

The Smith family’s current and emerging beneficiaries understand that an informed beneficiary works to understand and stay updated on the assets the trust manages, whether those assets are investments, properties, or operating businesses. They are not simply receivers of distributions from the trust. For the beneficiaries, it’s crucial that they feel listened to and know that their opinions matter to the trustee. In the context of the Smith family trust, since it is a generational trust and the beneficiaries won’t ever actually own shares, it’s essential that they understand how they can still impact the business through their opinions and relationship with the trustee.

Trusting Your Trustee

Introducing a successor trustee also gives space for conversations about building trust with your family’s trustee. The relationship with the successor trustee will be different from that with the original trustee since they may not necessarily be a family member or someone “known” to all the beneficiaries. Bringing onboard a new successor trustee is an excellent time to define the processes necessary to establish a new and healthy trustee-beneficiary relationship based upon the current asset group’s complexity, generational views, and generational skills.

In the case of the Smith family, the next generation is going into this relationship, having witnessed their parents, aunts, and uncles interact with Grover in a way that didn’t really account for other perspectives. This incoming generation wants to have more of a voice in the trust activities and create a more positive and interactive trustee-beneficiary relationship. Many trusts can become a hindrance to both family harmony and business success because of an unhealthy or underdeveloped trustee-beneficiary relationship.

So, how do beneficiaries build trust with their trustee? Education and communication are the cornerstones of the trustee-beneficiary relationship. Starting with education, it is important that the trustee/s and beneficiaries attend joint learning meetings wherein guest presenters can dig deep into topics that are relevant to the business, family, ownership, or the trust itself. Creating space for the trustee/s and beneficiaries to learn and discuss topics together builds a stronger bond than only talking when addressing a specific trust-related issue.

Regularly scheduled meetings also create space for the beneficiaries to develop a stronger understanding of the Trust’s assets and how they are performing as well as an opportunity for the trustee(s) to become more familiar with the beneficiaries, keeping up-to-date with their lives, wants, and needs so that they can be the best stewards possible of their trust and interests. It’s important that all those involved in the trust understand each other’s roles and feel comfortable expressing their opinions on any given topic.

Is the Trust Serving the Family, or is the Family Serving the Trust?

Over time it can be worthwhile for the beneficiaries and the trustee(s) to discuss if the trust is still serving the family and the business in the way it was originally intended to. As we previously noted, while trusts are intended to last several generations, they are not intended to be static or unchanging. If a trust is not functioning as intended, families can ask themselves if it needs to be dissolved or restructured into other trusts. This is not always possible, but there are trusts that allow for modifications due to how it was originally drafted and jurisdictions that are more receptive to modifications than others.

For the Smith family, they determined that while the current trust structure would continue to stand for now, conversations in the future might involve splitting the trust into multiple trusts to best serve the interest of the growing family. While land was once their most valuable asset, their other investments were now becoming more valuable. Additionally, with more children and grandchildren in the family, education was becoming an increasing cost concern, with an educational trust being a possible structure they might explore.

With a healthy, functional trustee-beneficiary relationship in place, the process of the beneficiaries casting their wishes for the business or the trust through the trustee can be a seamless one. Well-educated beneficiaries will communicate their wishes to their trustee, with whom they have a strong working relationship. The trustee will then carry out the wishes of the beneficiaries, knowing them to be trustworthy and knowledgeable about the business and the trust.

In their best forms, trusts can be a valuable tool to preserve and protect family wealth, but they are not a set-it-and-forget-it legal structure. They require intentionality and work to maintain their value. Having introduced a successor trustee to their family trust, the Smith family is now ready to continue building a healthy trustee-beneficiary relationship and updating the trust structure as the family continues to evolve and grow.

Additional Resources

March 8, 2024