Years after creating a board with independent directors, family business owners often say that it was one of the best decisions they ever made. It stands to reason that it’s important to keep the board vibrant and well-equipped to help the family enterprise prosper in the future. Regular board evaluations are an important means toward that end.

Some family business boards have director terms of say three years with staggered expirations and others simply hold annual elections. Some create age and / or term limits. Others think more qualitatively about active engagement, mental acuity and a soft target of up to ten years of service on the board. Irrespective of any of these approaches to board tenure, an essential step in a regular board evaluation process is the creation of a board matrix.

Defining the Cumulative Competence of a Board

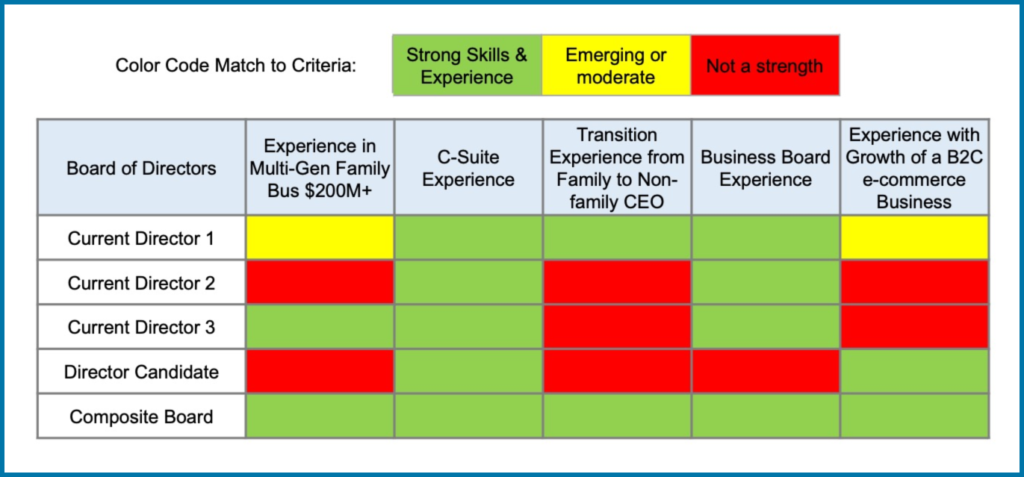

The board matrix identifies director skills, experiences and attributes that will be valuable in supporting the envisioned future for the family enterprise. Consider a second and third generation family business planning to grow from $200M to $500M in the next ten years powered in part by significant expansion of their fledgling direct to consumer e-commerce business. They anticipate promoting or recruiting a non-family CEO to fill a seven to ten year gap between when G2 wants to retire and someone from G3 will be ready to take over. Looking ahead, they see these (abbreviated) composite criteria for board members:

- Experience in a multi-generational family business with annual revenue over $200M and preferably over $500M

- C-Suite experience currently or very recently, preferably CEO or CFO

- Experienced with a transition from a family to a non-family CEO

- Business board experience

- At least one of the independent directors with experience overseeing the growth of a B2C e-commerce business

With criteria shown horizontally along the top, directors can be arrayed vertically including their age, tenure on the board and term expirations if applicable. The intersecting areas show how director skills and experiences match the future criteria. Gaps help guide director succession planning.

“An essential step in a regular board evaluation process is the creation of a board matrix.”

Gain Personal Insight

There is a lot more to creating a high-performing board than simply assembling people who match future criteria. One approach is for a third-party to interview owners and board members individually. To help encourage candor, the interviews are confidential in the sense that individual feedback is not shared. Instead the third-party shares consolidated results with the goal of identifying driving themes, important issues and solution options to help improve board effectiveness. Interview questions can cover things like:

- To what extent are the family and owner vision, values, and business expectations articulated, aligned and understood by the board?

- What are examples in pre-read materials and in Board meetings of effective use of the Board’s time and talents? What are examples that are relatively ineffective?

- How do you feel about the Company’s economic performance?

- What do you think are the biggest opportunities facing family owners and the business over the next few years? The biggest challenges?

- Among directors on the Board, to what extent is there a general understanding of the marketplace and how company leaders intend to win in the face of competition?

- What are the major areas of experience and skills you bring to the board and where do you feel you add the most value?

- What do you learn from serving on the board and roughly how long do you anticipate being available to serve?

Collect Data

Another approach is to have the board fill out a written survey which can be done internally while protecting the confidentiality of who said what on individual surveys. Or surveys can be carried out by third parties. What nuance may be missed through a written survey can be offset by the advantage of quantitative scoring and ranked results. Surveys can be administered annually or biennially to reveal trends. Surveys often ask a series of questions in areas like the following:

- Board role and general

- Company strategy and direction

- Risk management

- Board meetings and culture

- Board composition and structure

- Board organization

- CEO and senior leadership relations

- Shareholder relations

- Chair of the Board leadership

- Director contributions

A fast growing, profitable, multi-generational family business started with an inside board that included their trusted non-family CFO. After retirement, the CFO remained on the board. Over time the company added four independent directors. Some years later it was time to bring onto the board an additional independent director with current CFO experience in a larger family business. Through the process of creating a matrix showing future needs, the former CFO was able to see the appropriate time for his departure was at the end of the year. That kind of organic evolution is common with non-family directors.

Summary

The purpose of board evaluations is to help in recruiting and maintaining directors who can help the company prosper in the future and to build a high-performing team that sees that the business is well led in line with the owner’s vision, values and expectations for business performance. Those purposes can be advanced through a regularly updated board matrix, interviews and board surveys.