Adding the insight and oversight of independent directors to a family enterprise board begins with a solid commitment from the majority owners. That person or group of people must want a strong board with independent directors to meet their business challenges, take advantage of opportunities and achieve their goals.

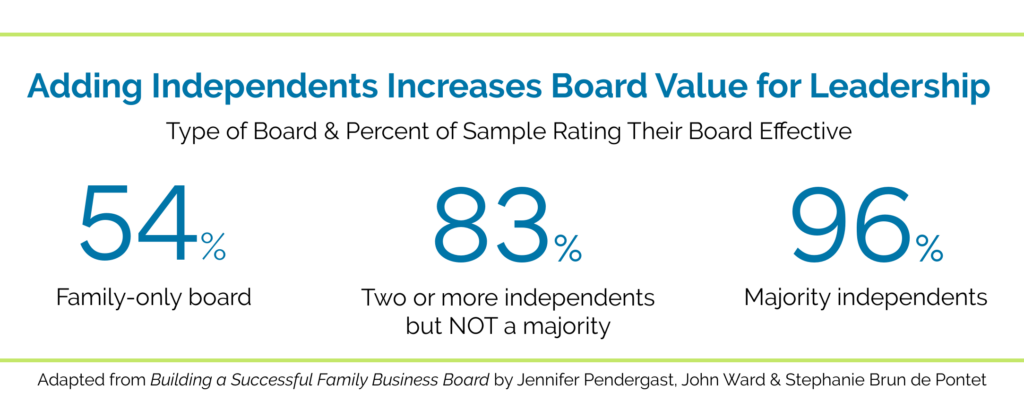

Boards with independent directors add value for owners and leadership by sharing relevant experiences, acting as a sounding board and providing valuable advice. Experience shows that businesses with boards that include three or more independent directors perform better, on average, over the long run. That should be compelling for owners.

Ownership’s Hesitations

Majority owners sometimes feel that an independent board of directors will 1) be an unnecessary expense, 2) involve too much time and effort to maintain or 3) boss them around and take control away.

Let’s consider these common concerns one by one.

Good independent directors don’t accept an outside board position just for the money. They do want to feel that their time and contributions are respected. There is a significant financial investment to create and maintain a board so that the directors are indeed valued.

Owners and leaders may feel that it’s not worth the time to create and maintain a board with independent directors. It’s true that the investment of time is significant. Preparation for board meetings requires not only background materials and performance information, but a distillation of the high-level challenges and opportunities in the business and what leadership would like from the board. It takes time to create the necessary focus in writing and to follow-up on good ideas.

Yet, years afterwards most business owners feel that establishing a board with independent directors was one of the best investments of money and time that they ever made.

Many owners who are also leaders in the business say they don’t want outsiders on the board bossing them around. That’s a misunderstanding. Directors serve at the pleasure of the majority owners. If the majority owners don’t like what directors are suggesting, they can readily move them off the board. However, there is a balance of power. If independent director advice is seldom considered, then they may leave the board of their own volition.

Minority shareholders, spouses, NextGens and others can encourage majority owners to create a board with independent directors by showing how it will help them meet their challenges, take advantage of opportunities and achieve their goals. But there is no getting around it: Majority owner commitment is an essential first step in preparing for an outside board.

Whose Dream Is It?

Three third-generation brothers were working in a furniture manufacturing business. Two loved the furniture business and one did not. His dream was boat manufacturing. The furniture business bought his shares. The brother used the proceeds to acquire a boat manufacturer — a business he loved and successfully led until retirement.

Majority owners have a dream for the enterprise. They may visualize the business prospering for generations. They may see selling the business with the proceeds creating retirement security and possibly a financial platform for NextGens to pursue their interests.

As family business enterprises succeed into the second and third generations and beyond, role distinctions emerge. In the beginning, the owner was the leader and board minutes may have just been prepared by a lawyer following a brief discussion to meet legal requirements.

In a multi-generational enterprise, the family includes multiple branches. Some are not interested in the family enterprise founded generations ago. They’re following their own dreams. To the extent they inherit ownership, they may be interested in cashing in their chips to help in pursuing their own interests and meeting their own goals.

Other family members may be interested in the family enterprise, but only as owners. They are pursuing their own careers but have a nostalgic heart for the family business. If dividends are paid, they may or may not be an important part of their annual income. When dividends are an important part of annual income, they can create conflict between leaders who want to re-invest more in the business and those who want to maintain dividend payouts. A high-performing board with independent directors can help arbitrate these differing perspectives in line with the owners’ vision and values.

Successful multi-generational family enterprises cultivate family relationships. They hold family meetings to share enterprise information. That kind of regular engagement goes a long way toward building and maintaining family harmony and creating NextGen interest in the family enterprise. Those who are interested can become owners and if they have the interest and ability, they may also earn a position in leadership and even on the board.

Owner, Board and Leadership Roles

A third-generation owner worked on the front lines of his family’s business as a teen. As an adult, dividends from gifted stock were supplemented by his earnings as an adventure guide. When his dad died, his mom took a seat on the board that included a non-family Chair & CEO. As majority shareholder, the mom ultimately elected her son to replace her on the board. The son’s initial instinct was to roam the front lines and middle management to get an up-to-date feel for the business. It took some time, but the son eventually learned how to stay in touch without disrupting leadership processes and became a value-adding director.

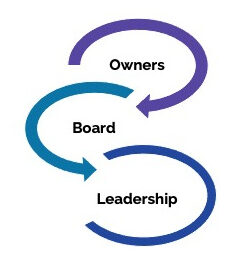

Owners set the vision, values and performance expectations for the business enterprise. A vision expresses in general terms where the owners would like to see the family enterprise go and the roles of family and non-family professionals on the board and in leadership. Values serve as a catalyst, an expression of pride and a guide for actions and endeavors. Performance expectations include growth, risk, financial return and liquidity parameters. Owners ideally speak in one voice to the board.

The board sees that the business is well run to achieve the owner’s vision, values and business expectations. The board does not run the business.

Leadership runs the business and is accountable to the board. Policies offering family members opportunities as a teen and during college years can build appreciation for the people on the front lines and for work itself. Many families require college graduates to work elsewhere, gaining experience and earning promotions before they can apply for full-time employment in the family firm. Those kinds of policies help distinguish performers who can be candidates for family enterprise top leadership in the long run.

Often non-family top leaders are helpful as enterprises succeed for multiple generations. They can serve as interim leaders. Or non-family professionals can become the norm in large enterprises where family engagement is largely centered on ownership and board level processes.

Preparing for a High-Performing Board

A second and third generation manufacturing company developed director criteria that supported their vision for the future. They sought three independent directors where their composite backgrounds would match the criteria. The requirements included experience in the following areas: board or C-Suite leadership level in a multi-generational family business with $200M+ in annual revenue; transition from one generation to the next; manufacturing; and finance. The trouble started when the G2 Chair suggested his lawyer, accountant and old fraternity brother as candidates.

Once the majority owners are ready to commit to the creation of a high-performing board with independent directors, there is plenty of work to do in preparation. A first step is to define the director skills and experiences that will be valuable in supporting the envisioned future of the family enterprise.

Independent directors are risk-taking peers unassociated with owners and the business. They are able to view the enterprise from a high-level, generalist’s perspective. Who do you leave out of consideration? Your banker, lawyer, accountant, financial planner, insurance agent, competitors, close friends, suppliers, customers and those who are overly committed. You pay your advisors for their advice in their sphere of expertise. Your independent directors are peers who give you objective feedback from a high-level generalists’ perspective.

Finding great candidates takes an organized effort that often includes third-party help. A board prospectus is an attractive, attention-getting document that outlines the company history, ownership, owner vision/values/expectations for business performance, top leadership and strategic focus. It also includes key financials, board organization/role, independent director criteria, meeting schedule, terms, evaluation process, compensation and protections. Blind and confidential versions will serve as tools to share with potential candidates and gauge their interest and fit.

An effective board requires openness about financials, alternatives, performance and more — things that many owners are used to keeping close to the vest. The confidential prospectus itself requires openness. Being ready to be candid is an important part of owner’s preparation for an effective board with independent directors. Many boards use non-disclosure agreements to help protect confidentiality and establish requirements to disclose conflicts of interest.

Board meetings are a group activity. Effective directors build on others’ ideas. They offer different options with grace and in a manner that maintain everyone’s dignity. Building in a way of observing board level interaction as part of the final independent director selection process is valuable. This can be done by conducting a simulated board meeting with the candidates to discuss an actual challenge in the business. How they interact with each other is just as important as the experience and expertise they bring to the table.

When candidates are narrowed to those who fit the criteria and are interested in serving, it comes down to mutual discernment and deciding.

The Important Link

A second-generation owner built the family business from $10 million annual revenue to over half a billion. It was a different matter for G3 to be ready to take over leadership than it was for G2. In this case, the board with outside directors encouraged recruitment of a CEO from the outside. She served for five years until G3 was ready to fill those shoes.

A board is the important link between owners and leaders in a well-designed and functioning family enterprise structure. The majority owners must want a high-performing board with independent directors in order for this structure to become a reality. The enterprise must have the required talent and ability among its leaders and advisors to provide needed information and insights to the board in an accurate, timely and organized way. Without such a team of leaders and advisors, the board is like a conductor without an orchestra.

When it all comes together, establishing a board with independent directors can be one of the most important decisions the majority owners make. It can create better performance and improve the potential for a family enterprise to prosper for generations.

Rob Sligh spent 33 years in family business leadership; initially in brand management at SC Johnson and then as 4th generation Chairman & CEO of a family-owned manufacturing company where they had a majority-outside board of directors. Over the years he’s served on 20 boards, many as Chairman or a Committee Chair. Today he serves on three private company boards and as a senior consultant with The Family Business Consulting Group.

Our board services are specialized for the unique needs of family businesses.

At the heart of family business success is a governance process that supports the business in its reach towards its future vision while adapting to the changing dynamics of the family, the ownership group and the management team as these groups themselves evolve. We recommend a tailored approach for each enterprise that reflects its unique strengths, challenges and opportunities, with consideration and appreciation for the family’s history, vision and dynamics.

To learn more about our approach, download our brochure, call (773) 604-5005 or email info@thefbcg.com. We can help.

January 11, 2023