Too often, great business-owning families assume that family and business represent ends of a continuum from which they must choose. To paraphrase James Collins and Jerry Porras in their seminal book, “Built to Last” (Harper, 1994), family business owners are often tortured by the “tyranny of the either/or” when they should “embrace the genius of both/and” in family business.

As the central concerns of business (winning, profits, etc.) are different from the core functions of family (nurturing, traditions, etc.), it is not surprising that many people believe the success of one has to come at some expense of the other. The assumption is either we make our choices and set priorities based only on the needs of the business or we focus on the needs of the family. For example, have you ever heard someone say you have to choose between family management and professional management? The implication of such a choice is that family members cannot be professional.

The danger of the either/or approach is that owners develop policies that ultimately harm the family and the business. One large family business I knew ceased to exist because the founder decreed that theirs was a “family first” business and any family member was entitled to a senior management job — irrespective of their actual qualifications. The result was an organization overburdened by an ineffective management structure that not only was inefficient but ultimately inept. By the third generation, there was so much conflict in vision and lack of initiative from senior management that the business lost its ability to compete in the industry. Further, the family was in such disarray as a result of the stress from the declining business that many relationships were damaged beyond repair.

The opposite approach can also be a recipe for failure. Another large family business I knew developed a preference for “professional management” that became a barrier to family members even being considered for roles of leadership in the company. As more non-family executives took control of senior management, they systematically shut-out family members who aspired to careers in the business to ensure “family concerns” could in no way cloud business decisions. The result, by the fifth generation, was a distant and disaffected group of family owners who did not understand the businesses they were in and therefore did not appreciate the need to reinvest capital for future growth. Conflict among the ownership led to division on the board and paralysis in strategy that eventually forced the sale of the company.

What these two examples underscore is the need for balance, and considering the needs of both the business and the family — to ensure the optimal functioning of both. Deciding that the leadership of the business should be left either to the family or to professional managers is an artificially forced choice. Further, it divorces the interests of the business from the family and vice versa when, ideally, the two should be closely aligned. The business should be managed by the strongest possible cadre of managers who have a deep understanding and appreciation of the family’s priorities for the business.

The best family business executives understand that a well-informed and engaged shareholder group is among the greatest competitive advantages they have as a company. Likewise, the family needs to appreciate that their interests as business owners are best served when qualified leaders are at the helm, working in partnership with family leaders as appropriate. While not a requirement for success, the involvement of qualified family members in leadership of the enterprise can help to ensure that the business has a good ongoing appreciation for the values and concerns of the family, and the family has a good “insider” appreciation of the needs and demands that are driving the business.

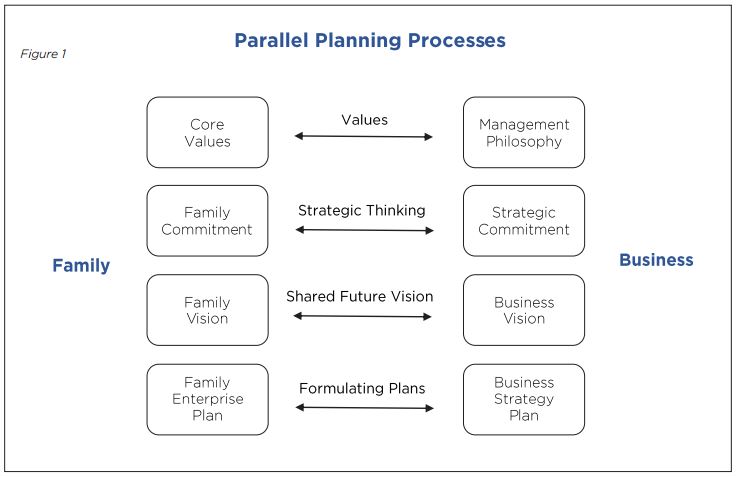

The parallel planning process, originally advanced by Randel Carlock and John Ward in “Strategic Planning for the Family and Business” (Palgrave, 2001), links these two powerful forces to recognize the real potential of family business. By helping both family and management create a business strategy that supports the interests of the family and the potential of the business, a powerful synergy can result.

While it is impossible to describe all the complexities of a successful family business plan in a static diagram, Figure 1 serves to show that strategic planning between family and business, owners and management can produce mutual commitment and alignment far beyond the normal range of fiduciary responsibility. Parallel planning for the family and the business will ensure that the strategic direction of the business is aligned with the overall goals of the family. When a family has a long-range vision for itself as owners of a business that is strategically positioned to support its goals for generations to come, patient capital is more readily made available to grow and nurture the business.

Figure 1 The strength of this model (Figure 1) lies in the application of four strategic principles:

1. Family values and business philosophy as the foundation for strategic planning. The family must first clarify the shared beliefs, experiences and legacies that unite them in their ownership and stewardship of the family enterprise. With parallel planning, these values serve as the underpinning of the business culture in which the company operates and define how the family will work to support the business’ future success.

2. Strategic thinking applied to both business and family. The opportunities that a business pursues must be appropriate to the strengths of the enterprise and in keeping with the vision of the owning family. Strategic planning ensures ongoing communication between the family and the business so that the leaders of the enterprise and the family align the family’s expectations with the needs of the business. Just as the business must proactively plan for growth, as the family expands, it must also plan for how it will continue to participate as “effective owners” and not simply leave this evolution to chance.

3. A shared future vision that guides both the family and the business. A shared vision considers how family expectations will be balanced against business needs in setting the vision for the future. Balancing the capabilities of the business and the priorities of the family the parallel planning process helps to set a sustainable vision for the future of the business and the family. Further, the process examines how family ownership of the enterprise will provide a strategic advantage to help the business bring this vision to life.

4. Formulating long-term plans to guide both the family and the business provides both the means to achieve success and the metrics to evaluate accomplishment of goals. The parallel planning process requires a commitment to have on-going conversations, to document decisions and to measure outcomes to determine if goals are being met. While this may seem like a lot of work, it becomes second nature over time, and the process itself contributes to strengthening both the business and the family.

Developing a family business continuity plan that is simultaneously focused on critical factors of success for both the family and the business requires more than just an assessment of strengths, weaknesses, opportunities and threats for a given organization in a particular industry. It answers the essential question of why does our family own this business and why should we continue to own this business? The answer may include the legacy of the founder, but must go far beyond the genesis of the enterprise to the mutual responsibility of accepting ownership. When family values are clarified and can be identified in the values of ownership they produce actionable business values that result in both psychological and financial returns.

The need to choose between “business-first” and “family-first” becomes irrelevant with the realization that assuring the success of the business now supports the continued well being of the family for generations to come. Formulating a business strategy that supports the current and future welfare of the family assures management and shareholder alignment for generations — such that these will survive economic downturns, create innovation and develop an enterprising family that succeeds in life. In the end, winning strategies must provide for winning families and winning businesses.