A cornerstone of effective family business governance is developing strong boards of directors. One board factor that correlates with family business performance and continuity is the addition of outside independent directors. Another factor that has not received as much attention, is the importance of developing family members into strong directors, capable of complementing the independent outside directors. These “governing family owners” and “non-owning family members” play a pivotal role in the success and continuity of the family business.

A natural first phase in family business governance is to create a family-only board. These initial boards are usually comprised of family-member owners working in the business. This family-only board often evolves to include younger generation family members working in the business who may not yet have ownership. Typically, the governing family members (both owners and non-owners) in this stage are narrowly-focused on the growth and operation of the family business’ current offerings and operation with limited outside influence.

“The roles of all board members are greatly enhanced with the appropriate selection of both family members and independent board members.”

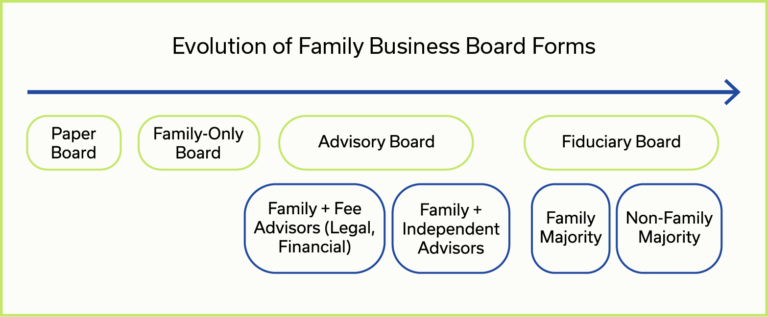

As the business develops further into the second and third generation, increasingly outside influence has greater impact. When transitions occur, governance often evolves from a family-only board, to an advisory board, to a fiduciary board with family members as the majority, and then to a fiduciary board with non-family members as the majority (see the figure 1). Each stage represents a meaningful change from the previous one.

Figure 1

Gaining Strength from Difference

As an example, the Irwin Seating Company has evolved from a family-only board when it was founded over 100 years ago to a fiduciary board today with four family members (two in the business and two outside the business) and four independent outside board members. This blend of board members has been effectively governing Irwin for the past several years. The two family members in the business have a deep understanding of the business, while the two family members outside the business and the independent board members working in other organizations bring unique perspectives to the table. During a recent assessment, there were several contributions the board members and executives cited as valuable:

- Acting as a sounding board

- Creating a level of accountability, particularly to the annual plan

- Assisting with banking and financial structures

- Providing guidance on estate planning matters

- Helping build shareholder relationships

- Giving encouragement and support, as well as challenging certain initiatives

- Providing in-depth support when critical events occur, most recently the turn-around of one division

Both the governing family members and the independent directors of a fiduciary board have some similar roles and responsibilities, including:

- Selecting and removing corporate officers

- Setting officer compensation

- Declaring dividends

- Holding management accountable for its performance

However, many family boards, like Irwin, take on more expansive roles, including:

- Reviewing and approving budgets

- Developing long-term strategic direction

- Serving on committees that oversee the audit and compensation process

- Assisting in creating policies

- Approving significant capital expenditures, including acquisitions

Mixing Expertise with Insight

Ultimately, the key to high-performance boards, whether advisory or fiduciary, is WHO sits around the board table. A complementary mix of skills and experiences relevant to the family business being served has proven to be a strong indicator for ongoing family business success. While having specific industry or functional experience is important, it is equally important to include members who have different industry or organizational experiences and a variety of functional expertise, including finance, marketing, sales, operations, human resources and information technology.

The roles of all board members are greatly enhanced with the appropriate selection of both family members and independent board members. It is unlikely that all family directors, particularly those not employed in the business, will possess the same level of skills and experience that independent directors bring to the table. An equally important attribute for board effectiveness is a profound understanding of the owning family. Therefore, it is best to establish qualifications and training for family directors to ensure they can function effectively on a board with independent directors.

Table 1 is a sample list of qualifications that show some of the unique differences between family and independent board members that one family business has used as their guideline for selecting a blend of qualified board members.

Table 1

Board Member Qualifications

| Family Board Member | Independent Board Member |

|---|---|

| Represent Family Shareholders: Able to effectively carry out the responsibilities a director has to all shareholders; not only a family branch. | Senior Leadership Track Record: Successfully performed at senior management/leadership positions (CEO, COO, CFO, EVP, VP, etc.). |

| Integrity: Acts discreetly with confidential data; a trusted and respected member of the family. | Board Experience: Has served on for-profit and non-profit boards. |

| Financial Acumen: Strong understanding of financial statements and analytical experience on using numbers to help drive decisions. | Industry Experience: Worked in or possesses a good understanding of the construction process for residential and commercial projects. |

| Business Understanding: Experience in exercising sound business judgment, a basic knowledge of the industry, competitors, clients, products & service offerings, the business model, company strategies and key metrics. | Employed or Recently Retired: A thirst for learning and still engaged to some level in the business world, either working full or part-time and/or serving as a consultant/advisor or board member. |

| Family Sensitivity: Sensitive to the nature of the family dynamics, and knowledge of family issues and idiosyncrasies. Open to concerns or ideas expressed by other family members. | Family Business Understanding: Familiarity with the culture and unique complexities of a closely-held family business. |

| Leadership and Outside Experience: Proven record of accomplishment in a prior position and/or outside experience that brings perspective in areas like science, finance, legal, marketing, or global development. | Battle Scars: Struggled through difficult times leading a business through a severe downturn, high-level growth, or industry disruption. |

| Strategic Thinking: Able to focus more on strategic issue resolution than tactical details. | Succession Experience: Involved in generational transfer of business. |

| Diplomatic Skills: Possess an ability to assertively disagree with enough forcefulness to be heard, without attacking, promoting an engaging exchange of views. | Reputation: Well-respected in given industry and community; matches up with Company’s values: humility, servant leadership, fact-based decision-making, etc. |

| Communication Skills: Possess an ability to clearly articulate concepts and events, an intuitive understanding of timing and frequency of communication to maximize trust & confidence. | Adaptable: Able to quickly adapt strategic thinking to ever-changing marketplace dynamics and move expeditiously when conditions call for change. |

Raising the Bar Realistically

Strong family business boards have consciously developed distinct criteria for family members and outside board members. To raise the bar on board member skills it is realistic to apply more demanding “business experience” qualifications for outside independent board members; and more demanding “family dynamics experience” qualifications for family members. The process of creating these qualifications and then applying them to the selection of board members greatly increases the probability of long-term continuity.

Source for selective data in article:

Pendergast, J., Ward, J. & Brun de Pontet, S. (2011). Building a Successful Family Business Board. New York. Palgrave Macmillan.