The most important reason why family businesses create a Board with independent directors is better company performance in the long run. Better performance allows families to build wealth inside and outside the business, contribute to their community and causes that are important to them and create opportunities for NextGen ownership and leadership development. No wonder many business-owning families say years later that creating a Board with independent directors was one of the best decisions they ever made.

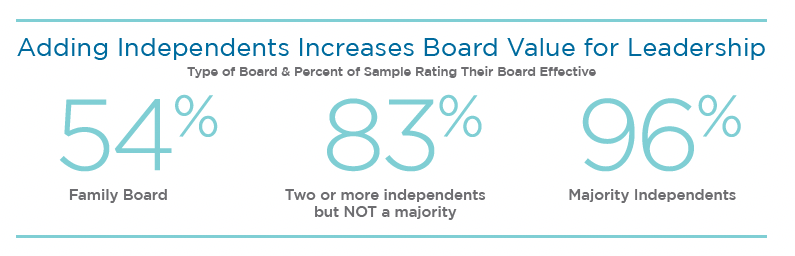

Our research shows that family businesses with independent directors on their Boards have much higher levels of Board effectiveness than those with no independent directors. Effectiveness increases with the amount of independent representation.1 That’s powerful support for creating and maintaining a family business Board with three or more independent directors.

Overall, the Board’s role is to see that the company is well-led to achieve the owner’s vision, values and expectations for business performance. The Board is active in providing inputs for the owners’ vision, values and expectations, evaluating viability and fairness, seeing that they are measurable and evaluating leadership progress. An effective Board’s demeanor is collaborative and collegial. Specifically, the Board’s role is to share experiences, act as a sounding board and contribute fresh ideas and insights in areas like:

- Shareholder returns, risk and liquidity

- Ownership interests and ownership succession

- CEO selection, compensation, evaluation and succession

- Oversight of top leader development, feedback processes, compensation and succession.

- Strategic planning and competitive positioning

- Sources and uses of capital

- Sounding Board for important initiatives, divestitures and acquisitions

- Supportive guide, validator and accountability forum

- Stewards for company culture

Building Trust and Family Harmony

Independent directors create trust by influencing decisions like how much to reinvest in the family business, how to mitigate or diversify risk, and what portion of capital can be set aside for redemptions and what should be distributed to shareholders.

Independent directors give credence to the Board’s oversight of leadership performance and compensation. Independent directors can see to it that leadership compensation is marketplace-competitive and based on performance. When leadership succession and compensation are seen as fair and objective, it helps create and maintain harmony among family owners who may be involved or not involved in the business.

For example: A multi-generation, business-owning family was experiencing disharmony. Family owners outside the business felt the family insiders were paying themselves too much at their expense. Insiders felt needed reinvestments in machinery and equipment were unduly constrained by the outsiders’ insistence on higher dividends.

Fortunately, the company’s independent directors had earned the trust of family members both inside and outside the business. They organized studies of peer-company returns, dividends and executive compensation and oversaw the creation of a strategic plan that specified the needs for capital investment. The result was a balanced plan for capital allocation that took all owner goals and business needs into account and brought about much better family harmony.

What is an Independent Director?

A director is independent when they are not a family member, close personal friend, professional advisor to the family or company, or a current or recent employee. An independent director is not a supplier or customer and not a financial partner with a family member in another venture. On a well-designed Board, independent directors bring skills and experiences that the family enterprise needs for the future. They have been where the enterprise wants to go in terms of things like scale, geography and new markets. They are perceived as fair by the full range of owners, family members and other stakeholders.

On effective Boards, pre-read information distills background relating to the high-level issues and opportunities to be discussed at the Board meeting. Pre-reads identify what leaders want from the Board. That way, time in the Board meeting itself is largely invested in valuable, interactive discussion.

In the context of a Board with independent directors, the Chair or CEO can spark productive experience sharing at Board meetings with a variety of prompts:

- I see this as a tough decision…

- I’m torn between two alternatives…

- I can’t see any good options…

- I’m having second thoughts about our direction on this. What do you think?

Diversity and its Role in Better Board Decision-Making

Boards often look to CEOs of a company of the same size or a little larger in a market or industry with relatable characteristics. At times this amounts to adding directors by cloning themselves.

But often there are particular skills, experiences or backgrounds needed for the envisioned future of the enterprise when filling a seat on the Board. It may be in the area of corporate finance including the evaluation and integration of acquisitions. Or systems experience including cyber security or e-commerce. Or the Board may be looking to improve diversity in perspective, experience, geography, age, generation, gender, race and/or cultural background.

These are all forms of diversity that add value to a Board when they are aimed at supporting the intended future of the business enterprise. A collegial Board that listens respectfully to a variety of views and considers a broad range of options makes better decisions than Boards that essentially clone themselves when adding new members.

When to form a Board with Independent Directors?

The impetus to add independent directors to a Board takes a variety of forms:

- When the person responsible for business operations isn’t the sole owner

- When other members of the family share ownership but not leadership responsibilities

- When ownership is spread across a large group of shareholders in increasingly smaller percentages

- When the business is transitioning to the second generation and beyond and ownership is seeking more effective corporate governance

But actually any time is a good time for a family business of sufficient scale to set up a Board with independent directors. After all, who doesn’t want better company performance in the long run?

1 Adapted from Jennifer Pendergast, John Ward and Stephanie Brun de Pontet. Building a Successful Family Business Board: Palgrave Macmillan, 2011, 17-23.

March 18, 2022