“Most business advisors build blast shields. You guys disarm live time bombs!” remarked a friend of our firm, who just so happens to be a lawyer.

In my close to 30 years as a family business consultant, I’ve come to appreciate that we’re a different breed of cat in general (and most certainly in our shop) than any other of type professional business advisor. Reading directly from our company’s Mission Statement “We ensure our clients prosper across generations protecting the integrity of both the family AND the enterprise.” Understandably, most business leaders would prefer to build a brick wall between the two. Yet, dear reader, you know in your heart that the two – at least in any multi-generational family enterprise – are interdependent.

The really good family business experts out there know how to leverage both for mutual benefit. These same experts also know when it makes sense to throw in the towel; consider other options; and, if there’s a family member who needs to be moved (or removed), orchestrate the event in ways that protect the person’s dignity as best we can.

This article will help you understand how an excellent family business consultant, also known as a family enterprise advisor, can provide a different sort of value to your family and its enterprise than your other advisors.

What’s the value proposition?

No group of family members are going to wake up and say in unison: “Let’s hire a family business consultant!” What owning families want to buy or invest in are results like:

- Ensuring or recapturing family harmony;

- A shared vision for their family and the company they control;

- Implementing a leadership transition in the business that is sustainable and good for business;

- Successful continuity of ownership to another generation;

- All family shareholders, especially those who don’t work in the business, understanding fully what it is they own (and don’t own);

- Clear understanding and alignment around each family member’s roles and responsibilities in relation to the enterprise;

- A common nomenclature that has everyone singing from the same page of the hymnal; and,

- Finding common ground on everything from compensation to stock valuation, leadership to governance, and transparency to confidentiality.

Families want safe processes that produce safe structures to ensure that siblings, cousins, or in some cases, in-laws work in the business and/or own stock in the business because they want to and can add value to the enterprise — not because they were coerced or born into the right family. This is no easy feat. Fortunately, owning families are embracing the idea that: “Maybe if we get some outside help from someone who really understands why this is so gosh darn difficult, we’ll all get along better and make more money in the process.”

They want to understand, with acute clarity, everyone’s expectations for the future including the company’s growth, the owner’s liquidity demands, the company’s profitability, the owner’s capital risk tolerance, desired leadership, etc. They also want to trust that the same processes offer an option for those who don’t want a seat at the table to exit gracefully and fairly.

Why do families hire a family business consultant?

Prospective clients reach out to us for one of two reasons. In about half the cases, one or more members of the owning family have become students of the field of family business. They read relevant books, attend conferences, and subscribe to journals and webinars. They gain the respect of others in the family as they share some of what they are learning and eventually build up enough leadership to convince the other members to at least interview a few family business consultants to get a sense of what benefits the consulting process will bring to the family and its enterprise.

The second and just as frequent reason families reach out to us is because life in the family business is not playing out as everyone had hoped. There may be stresses, tensions, arguments, bad behaviors, or lack of alignment around why they are in business together. (For more on this, read Dana Telford’s terrific FBA article: From Partners by Chance to Partners by Choice: The 7 Cs of Trust-based Partnerships.) Or they don’t know how to safeguard their company’s continuity because they cannot envision a plan for leadership and ownership transition that doesn’t cause some discomfort.

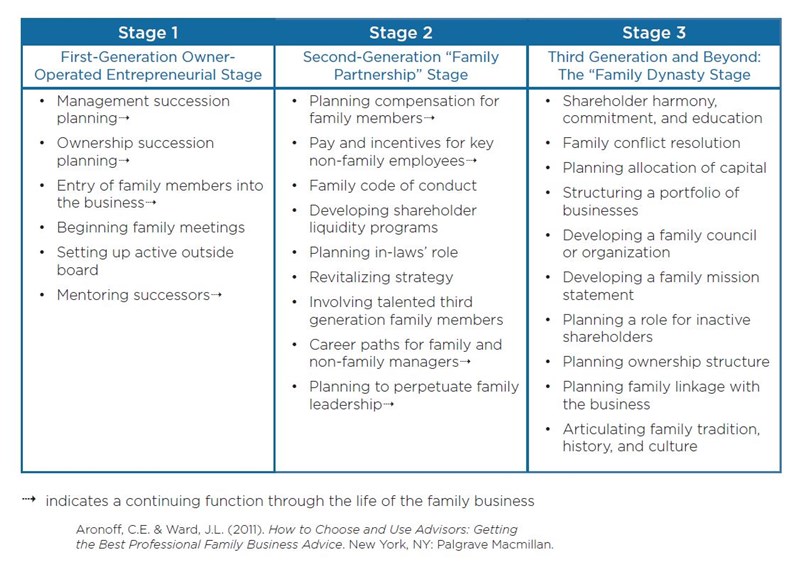

Another facet that influences when to and why bring in outside help depends on the generation of ownership and the needs of the family and business. The chart below outlines where independent guidance can be most helpful as the family business passes through three common stages:

What makes an excellent family business consultant?

In my experience, the ideal family business consultant is an objective, outside, independent person or team who:

- Regards all members of the owning family and the enterprise as the client;

- Is not motivated to manage your money, sell your business, or sell you insurance.

That’s not to say family businesses don’t need and benefit from insurance advice and products, legal, financial, banking, accounting, or other services. You need these also. This is not an “either/or” but a “yes/and” undertaking. In fact, the very best engagement outcomes happen when these other advisors are given permission to collaborate with the family business consultant. This dramatically increases the likelihood that your estate plans are more than tax efficient, they reflect the capabilities of the next generation, and the shared expectations future owners have of themselves and one another.

An effective family business consultant will listen first, then ask fantastic questions to understand the unique qualities and values of your family and your enterprise. She will build trust with everyone involved and be the model of tact and transparency. He will appreciate that there are at least four distinct, dynamic systems at work: family, management, ownership, and governance (eg. board of directors, advisory board, family council). The consultant will help all of your family understand that the company’s strategy, board and ownership group all need to be aligned. If they’re not, the consultant will be very skilled at getting them on the same page.

The right consultant will not come to you with a templated answer or methodology. In fact, the “right answer and right approach” will depend on where your family is on the learning curve of family enterprise continuity and what have been the actions, transactions and decisions that have led you all to being where you’re at today.

Dr. Bernie Kliska, one of our retired consultants, best explained: “Helping to cultivate harmony is an important part of the consultant’s involvement. Family businesses are incredibly complex entities. Family business members inherently need to work through a broad range of complicated challenges, with the consequences of failure being not only the loss of the business, but also potentially the loss of the love found in family relationships.”

What will you experience if you hire a family business consultant?

An engagement with a family business consultant will vary — no two will be the same just as no two families or businesses are the same. However, there are some aspects we frequently see while working with our clients.

Most engagements begin with a discovery or data collection phase. The information the consultant asks to review is determined by the goals of the engagement and the circumstances that led you to reach out to a family business consultant.

The consultant may want to begin the engagement with confidential personal interviews of all the key stakeholders. The definition of “stakeholder” varies client to client, but could include:

- Family members employed in the business

- In-laws (they’re the parents of the next generation)

- Shareholders (and those intended to be)

- Trustees of trusts which hold stock or shared family assets

- Beneficiaries

- Members of the board

- Key non-family executives

- Estate planning and corporate attorneys

The consultant may ask to review the company’s:

- Financial statements

- By-laws

- Shareholder agreements

- Organizational charts

- Vision statements, mission statements, and your strategic plan as well as the process that was used to create these.

- Trust documents which relate to trusts as repositories of stock in the company and estate plans not for purposes of re-writing anything but only to be cognizant of the boundaries within which recommendations may need to land.

- Compensation policies

The consultant will hopefully request to tour the company’s facilities, learn its history, find out who owns how much of what, and understand whether real estate or other assets are held in the operating company or in other entities.

Following the data collection and discovery phase, you’ll probably have a kick-off meeting with the consultant. The consultant will not only collaborate with you to design the agenda, s/he will also help by recommending who should attend this first meeting. And, then there will be more meetings, perhaps as often as monthly, quarterly, or as infrequently as once or twice a year. Each meeting will have an agenda and will be a part of a larger process intended to strengthen the family, bring meaning to its ownership, clarity to its purpose and expectations of growth and profitability.

On the other hand, there are also engagements where our discovery and work scope may be limited to only a few meetings with a pair of siblings or a few cousins who just cannot see eye-to-eye on a matter and are seeking an informed, independent, objective, neutral party to help them work through a thorny issue.

Summary

The world needs family business consultants because the mixture of family and business, while potentially volatile, also holds the ingredients of great emotional and financial reward to the owning family and all its stakeholders. An excellent family business consultant is probably the only advisor you’ll work with who considers how family, management, ownership and governance impact each other on a day-to-day basis and is able to create a safe place to openly and creatively consider how these four necessary systems uniquely and powerfully affect your family and your enterprise.

The trend is global. Business-owning families everywhere are recognizing that family firm continuity is extremely complex and challenging. The good news is that you are not alone. Independent, highly skilled family business expertise is available and can bring about shareholder alignment, family harmony, and efficient decision making processes to ultimately protect the two things you most care about: your family and your enterprise.