The three-generation Sanders family business was facing a crossroads. The company has made it through the rollercoaster ride of the Pandemic and is experiencing renewed growth and stability. Members of the first generation, Bill “Sandy” and Sally, are in their 70s and are ready to dedicate themselves to a new adventure beyond the company. Their three adult children, Pat, Jamie and Chris are involved in the company as owners and board members. Jamie and Chris continue to have a role in the operations, although the key executive roles are now held by non-family members. With the third generation just beginning their careers in the company, the family needs to make some decisions around succession.

We asked the million-dollar question: “How aligned do you think you all are in your goals and thinking about your ownership? Are you all in agreement on the matters of growth, risk, profitability, and liquidity?”

Silence was followed by restlessness in their chairs. Family members looked from one to another, wondering who was going to speak first and, more importantly, whether they would agree. The silence seemed to go on for a long time.

Matters of Growth, Risk, Profitability and Liquidity

When it comes to owner alignment, agreement on the four elements of the GRPL model (Growth, Risk, Profitability and Liquidity) serves as the critical foundation for forward progress. When a family enterprise agrees on how to measure and track key GRPL metrics, the stage is set for the family, owners and company leadership alike to all follow the same set of “marching orders.” It also creates a game plan and sense of accountability for the entire system, as my colleagues Lisa M. Morel and Joshua Nacht, Ph.D. detailed so well in their article “Achieving Ownership Alignment on Financial Goals.”

Every family enterprise serves the needs of a wide variety of constituencies between the family, owners, and business. The needs are unique while simultaneously deeply intertwining and dependent upon one another. The GRPL dashboard ultimately reflects the harmonized agreement for the enterprise.

Where Does It Begin?

Many family enterprises react as the Sanders did when asked about their alignment around GRPL. It can be challenging to know where to begin as you define the key metrics. Ultimately, the metrics reflect the performance of the company, in the form of growth and profitability. The impact of the growth and profitability is manifested in the absorption of risk in the system and the availability of liquidity to the business, owners and, beneficially, the family.

It’s tempting to begin the GRPL journey at the company level. However, experience tells us the best opportunity for alignment exists when we start with the individual.

For example, Sandy and Sally have reached a time in their lives where they have adequate resources at their disposal. Their appetite for the adrenaline rush that comes from high-octane growth in revenue and profits of the company was satisfied years ago. Their goals are now focused on taking care of one another and the family and achieving other goals around philanthropy and social impact.

In contrast, their adult children are at a different phase in their lives. Pat is easy going and secure both personally, professionally and financially. There are no complaints and according to Pat, “Things can just keep going like they have.” Chris, the oldest, enjoys being part of the board because it provides connection to the family business. However, Chris would also be more than happy to step away from it entirely to pursue other interests. Jamie, on the other hand, recently remarried and has started a second family with two toddlers. Jamie needs to remain engaged, employed and making the most out of every aspect of ownership and operation of the company, aligning more with the sentiments of the third-generation family members working in the company.

As each person considers their own needs, there is a balancing exercise that occurs. There is a natural tension between the four GRPL elements, a tug-of-war between Risk and Growth, Profitability and Liquidity. Risk, by definition, is uncertainty relative to the impact of an event or outcome on the achievement of an objective. Put another way, risk is the degree to which an action may have a negative or positive impact on you achieving your goal.

When there is an emphasis on mitigating negative consequences, it is likely that growth, profitability, and/or liquidity will be curbed. Conversely, an aggressive growth strategy inherently increases risk, which may or may not threaten profitability and liquidity. The positive consequences could be tremendous. The negative consequences could be disastrous.

The process starts with the individual. Each member of the Sanders family was encouraged to reflect on what their personal expectations were as an owner in the enterprise. To what degree did they want to be involved? What are their expectations for degree to which they want to take on the risk and liabilities of ownership? From a personal financial perspective, what are their needs for compensation and/or dividends from the company?

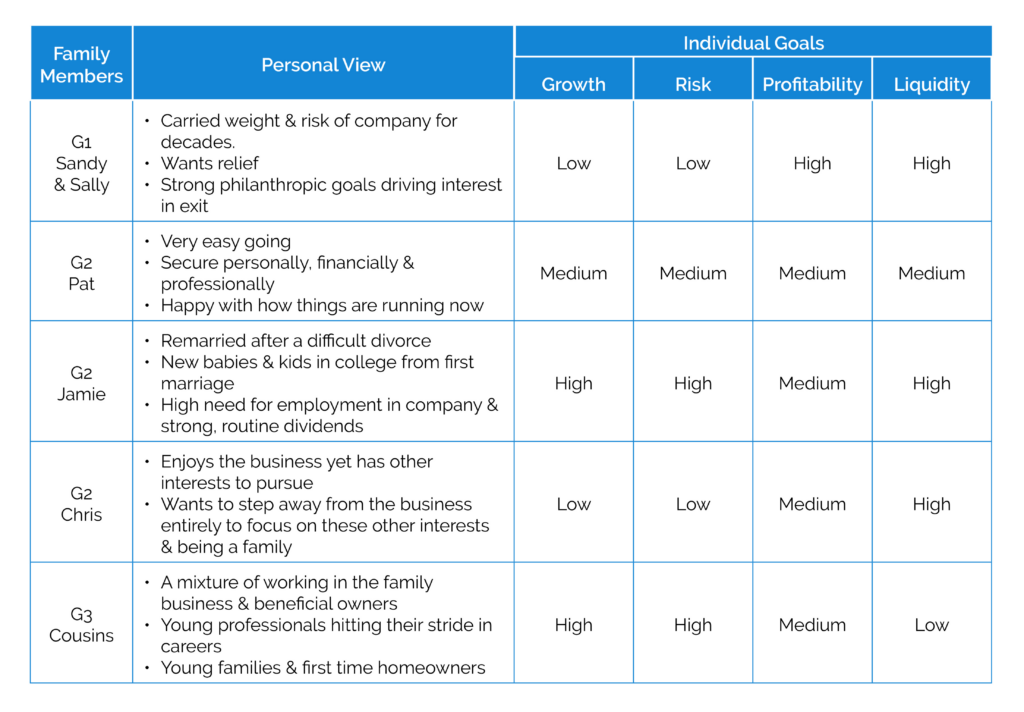

As a group of individuals, the GRPL profile can be summarized as:

Once the self-reflection is completed, the information needs to be shared with and heard by others. This demands a certain level of listening and communication skill across the family group so the discussion can be purposeful and intentional, with a base regard for the speaker and their value as a member of the family. By acknowledging individual appetites for risk and needs for growth, profitability and liquidity, we build understanding across the enterprise. With this broader and deeper understanding of the respective needs, the enterprise enhances its ability to build alignment and consensus.

The Sanders Dilemma

In the case of the Sandy and Sally, they were at the point where they prioritized liquidity and wanted to eliminate their risks of ownership. They brought a sensibility to this and wanted to work with company leadership to ready the business for the transition while encouraging growth in value and infrastructure. This information was communicated to their children, and it was agreed that they would craft a three-year plan to accommodate Sandy and Sally’s wishes.

One of the first steps in their action plan was to obtain a valuation of the company as a baseline for planning as well as developing the executive succession plan. When the valuation was above what Sally and Sandy had been assuming it would be, they began to question:

- Should we stay the course of a three-year plan or accelerate our timing?

- Should we continue to make the investments in growth that we have built into the strategic plan and financial projections?

- What is the feasibility of redemption of stock? What is the cash flow impact on the operating company and, in turn, the impact on its ability to weather future economic cycles?

- What options should we explore to meet the diverse needs of those looking to exit compared to those committed to remain as owners?

- What’s important to us, as individuals, a family, and shareholder group beyond the financial quantitative aspects compared to the qualitative and legacy implications? Where are the points at which the scales tip in one direction or another?

The Approach Toward Alignment

The Sanders family enterprise had a long history of being able to work through challenging times. That said, there were tremendous differences between them in terms of how they viewed the world and how they processed information. For example, Sandy and Chris were fast-paced, high-energy decision makers. Sally, Jamie and Pat preferred to gather more information and input before making high-stakes decisions. Sandy, Jamie and Pat had a higher degree of comfort with numbers and financials whereas Sally and Chris were far less confident.

As with every family, they also knew how to press each other’s buttons. At times, emotions would cloud the conversations. Jealousy and favoritism, whether real or perceived, would spark an impasse. Conversations would stall as family members retreated to their corners.

Both generations recognized that they needed an impartial facilitator to guide them. They needed someone with no skin in the game to lay the data out on the table and translate when applicable. In situations like this, The Family Business Consulting Group is often brought in to help the family better understand the GRPL model, as individuals and a group, to achieve the alignment necessary for successful decision making.

In our work together, we crafted a process for the Sanders that:

- Identified individual learning, information and communication styles to build self-awareness and broader understanding of ways to more effectively problem solve together.

- Enhanced the enterprise’s understanding of the underlying factors in the GRPL model through education and review of financial trends of the company.

- Facilitated self-reflection on individual needs which in turn led to facilitated conversations as a group to build deeper understanding of the shared priorities of the enterprise.

- Developed consensus around acceptable metrics and frameworks for succession.

- Developed an action plan for achieving the agreed-upon goals and timing of the succession plan.

By investing the time and resources in developing a process, the Sanders team was able to address the questions in a well-considered and balanced manner. Rather than allowing the differing needs to stall them, individuals have the opportunity to voice their opinions and needs. By giving voice, the leaders charged with making the ultimate decisions could have better awareness of and weigh the varying needs. Those individuals without a direct say in the decision recognized that the decision makers were following a process that was organized, inclusive and fair. While the decision may not be what a given person wanted personally, the transparency of the decision-making process and information provided a path for accepting the decisions.

The Positive Impact of GRPL Alignment

The results were readily accepted by the enterprise, including:

- The enterprise recognized and respected Sandy and Sally’s interest in liquidity. Collaboration among the family council, board of directors and leadership developed a strategy around their exit from owning certain operating and non-operating assets. This provided Sandy and Sally the funds to make the level of investment in their philanthropic projects while still alive and fine tune their estate plan’s legacy planning component.

- After robust discussion, the enterprise decided to moderate the investments in growth slightly, lowering the targeted growth rate and strategically pulling back on certain investments that would not sacrifice the long-term health, growth and profitability.

- The enterprise implemented a program for the annual adoption of specific metrics to guide both the strategic plan and measurement of performance for each of the GRPL components. The facilitated discussions resulted in an enhanced understanding of the dynamic and interrelated nature between growth, risk, profitability and risk. As such, family members, board members and the leadership team deepened their knowledge and respect for striking the right balance for the Sanders enterprise.

Conclusion

The Sanders family worked hard to listen to each other, to learn together and invested the time to hold critical discussions that would determine their future. They recognized that the crossroads faced were going to be both impactful and potentially emotional for the members of the family. A well-considered and facilitated process opened the door for including the full range of interested parties from the family and leadership of the companies. By giving everyone a voice and a level of transparency that reinforced their process, the Sanders family had a path for effective decision making that reinforced trust.

As a family enterprise, it is vital to evaluate the level of alignment in key areas such as growth, profit, risk and liquidity. Are all your family members on the same page when it comes to the future direction of the business? Is everyone aware of the risks and rewards associated with different financial decisions?

By improving alignment in these areas, your family business can unlock a world of opportunities for success and continuity.

We value confidentiality. The examples mentioned in this article are composites based on our client experiences.

May 8, 2023