For entrepreneurial families, the family business is more than a way to make a living. It is the embodiment of generations of values, drive, commitment, and hard-won success. It also represents hope for the future: the chance to contribute to their industry and community, and to offer the next generation opportunities for lives of meaningful contribution.

Family enterprises also enjoy a key competitive advantage: the shared commitment of the owning family. Long-term thinking, a conservative approach to risk, and aligned control create stability and unique opportunities, along with a higher level of trust than public corporations. Their stewardship mentality and values-based decisions strengthen relationships with customers, employees, and their community — creating value for everyone.

Today, families are called to protect and leverage this advantage. Shifts in the market, economy, and technology require proactive leadership and decision-making. Many families are also managing diverse holdings of businesses, investments, philanthropic assets, and more. At the same time, they are more likely than ever to be approached with an offer to sell, prompting them to consider what it means to continue in business together.

The family’s ability to move forward while remaining grounded in their values and legacy has never been more critical. Yet many planning approaches overlook the family’s vision of success — and their role in achieving it.

“The key idea is to shift the family’s focus from the business as glue of the family to the family as the glue of the family.”

~John L. Ward, Co-founder of The Family Business Consulting Group

The Importance of Investing in Family

Often, families first recognize the importance of family investment as they approach a generational transition, while juggling planning activities across multiple areas:

- Business: Leadership succession, ownership transition, and board governance

- Wealth: Investing, estate planning, individual financial plans, premarital agreements, and insurance

- Philanthropy: Vision, mission, leadership, governance, and engaging younger family members in giving

- Individual: Retirement planning for the current generation and career planning for the rising generation

Yet, the concerns we hear most are distinctly human:

What if the family doesn’t agree that Kerry is the best choice for CEO?

Will my children understand and thrive within the terms of the family trust?

What if no one in the next generation wants to be involved in the business?

These concerns reveal the truth — that the success of the family enterprise lies with the family.

Indeed, families’ definition of success is rarely financial. Families use words like joy, opportunity, growth, relationship, commitment, trust, and stewardship. They talk about rising to opportunities and challenges together. Most often, success is pride and confidence in their family’s legacy thriving for generations to come.

The good news? Families are often surprised to learn that their commitment, values, and long-term view also contribute to stronger financial performance over longer timelines, while reducing risk, ensuring stable capital, and strengthening their ability to seize new opportunities.

When you consider the emotional and economic rewards that an engaged and committed owning family can enjoy together, it’s no wonder that families are recognizing that one of their most important investments is in the family.

Three Building Blocks of the Family Advantage™

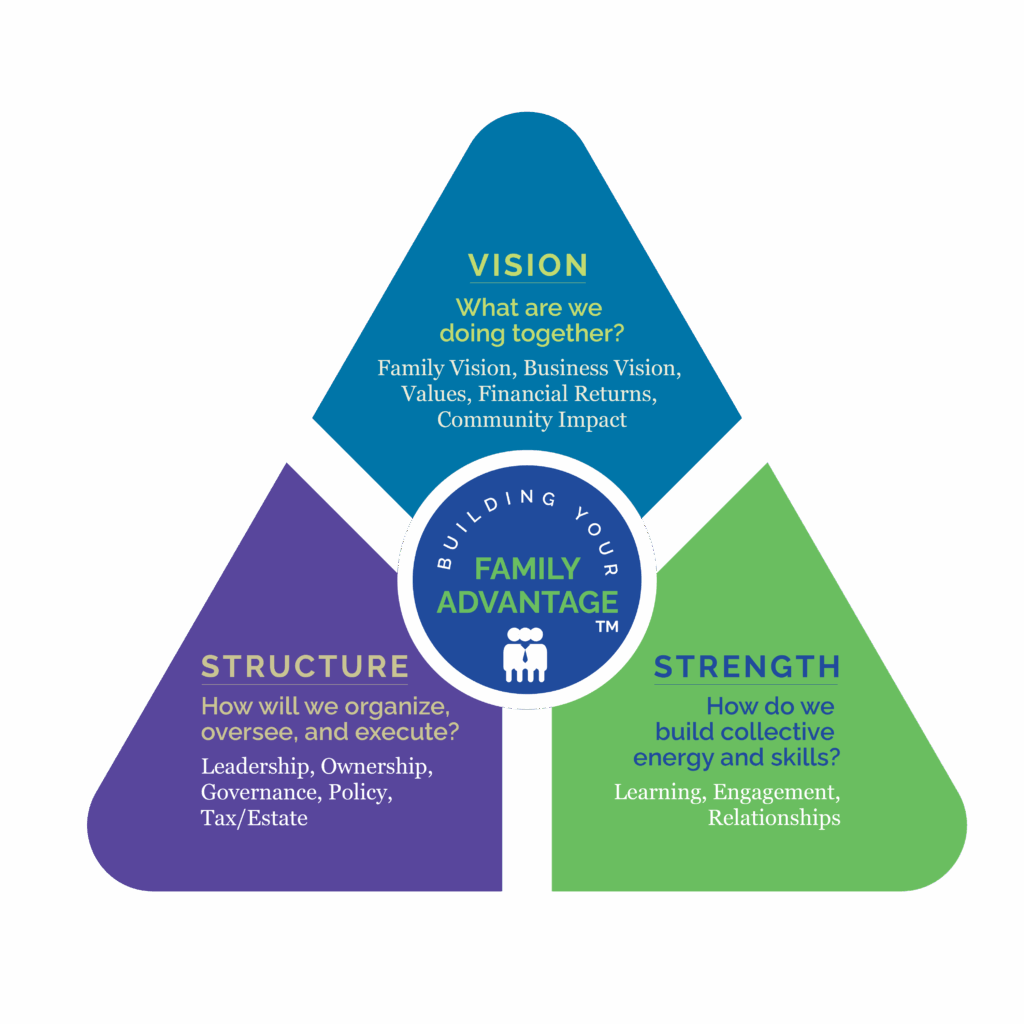

Generational transition is only one kind of change that families will face. In truth, family firms — like all businesses today — are in a state of constant evolution. After working with thousands of families, we’ve discovered that those who evolve and thrive across generations focus on three interconnected building blocks of effective family ownership:

- Vision: What are we doing together?

Rooted in the family’s values, a shared vision captures the family’s aspirational direction for the future of the enterprise. It integrates business goals, desired financial returns, and the impact they hope to make in the community. - Structure: How will we organize, oversee, and execute?

Structure provides the framework that turns vision into reality. This includes agreements that give family members clear ways to engage and add value, and balance entrepreneurial drive with oversight and protection of the family’s legacy. - Family Strength: How do we build collective energy and skills?

Family strength reflects the human capital that sustains the enterprise across generations, such as knowledge, skills, commitment, and resilient relationships. Promoting learning, building trust, and engaging family members creates the capacity to lead and steward the enterprise for the future.

Using the Family Advantage Lens to Solve Challenges

Together, vision, structure, and family strength create stability and align the family’s energy to protect and grow the family advantage. Weakness in any of these areas can produce challenges. The key is to build the family’s capabilities — across current and future generations — to support the rest of the plan.

Looking at family opportunities and challenges through the Family Advantage lens can be a helpful exercise in identifying solutions.

| Challenge | Vision What are we doing together? | Structure How do we organize, oversee, and execute? | Family Strength How do we build collective energy and skills? |

| Stalled succession plan | Do we agree on what we need for future leadership? | Is it clear who makes the decision and how? Will there be appropriate oversight for the future leader? | Does the family trust the process? Is there confidence and support for the future leader’s success? |

| Lack of engagement from young adults in the family | Is there a compelling story for the future and how can they be a part of it? | Is it clear how they can become informed and involved? | What skills and experiences will help them understand and value their role? |

| Ineffective board of directors | Has the family clearly shared its vision with the board? | Does the board have the right mix of family and non-family skills and experiences to address the enterprise needs? | Are family directors prepared to fill their distinct board roles? |

Case Examples: Putting Family Advantage into Practice

Inspired by families we’ve worked with, the following vignettes illustrate how identifying and connecting vision, structure, and family strength helps families realize their unique family advantage.

A Family Poised for Growth

A third-generation family firm had stagnated. Seven cousins working in the business were experiencing tension that stalled growth and succession planning. The group felt worn down and was considering a sale. Through our work together, the family would learn that what looked like waning family strength was being caused by gaps in vision and structure.

Early conversations focused on helping them defuse the family conflict, appreciate their strengths, and create new norms for tackling challenging topics. With these new skills, the family began to deeply consider the company’s current state and their desires for the future. As frustration dissipated, excitement over driving growth grew.

The family defined a shared family vision, then engaged their non-family leadership in cascading that into a unified business vision. Within weeks, this unleashed conversations about how they would accomplish their business visions in key strategic verticals. Innovation, investment, client experience, and team development all had actionable goals that tied to the business vision, which flowed naturally into execution.

After achieving strategic alignment, it became clear to the family that there were gaps and redundancies in the organizational chart and that the role structure was a primary reason for family conflict. Revamping the organizational chart created opportunities for a more strategic look at CEO succession, clarified roles for family members, and identified areas where the company would need new outside hires to fill key gaps.

While the family is just starting to see the growth they anticipate from their strategic plan, they are already experiencing the renewed energy across the organization that comes with a clear and compelling vision and unified owner voice. Best of all, they are enjoying the fruits of stronger family relationships while they do it.

Building the Next Generation of Entrepreneurs

After a fourth-generation family decided to sell their legacy business, they faced a new set of questions together. Their enterprise now included financial assets, real estate, and other holdings. The family needed to decide on approaches for managing their investments, overseeing their properties, and handling their taxes and administration. They also wanted to grow the impact of their family foundation.

However, conflict over decision-making paralyzed them, causing lost opportunities and frustration.

A lack of vision for this chapter in their family’s journey was impacting their ability to create structure to manage their shared assets and impact. And while there was great family strength for operating a business, different skills would be needed for their new enterprise.

Working with FBCG, the family’s early conversations revealed a strong commitment to keeping the entrepreneurial spark alive across generations. After deciding how much capital should remain in the enterprise, the family began investing in startups within their industry and set aside funds to support new business ideas for the next generation.

From there, the family gained greater clarity on how each of their assets connected to their shared vision and the management required to steward them. While familiar with a family office, they concluded that it was too early to know what level of centralized management they would ultimately need. Instead, they defined interim paid roles for family members to manage certain aspects of their portfolio, with FBCG’s support in finding specialist advisors for key activities.

Two years into this process, the family has added three growing businesses to their portfolio. They continue to evaluate whether they may transition to a multi-family office. They are now seeing strong financial returns — both individually and as a group — through smart management of their funds, and have turned their attention to making a bigger impact in the philanthropic areas that matter most to them.

Start Where You Are: Practical First Steps

Some families need comprehensive planning — especially when the family or the assets are large and complex. Others prefer informal approaches where agreements develop naturally. The right approach is what works for your family. To kick off the next step in building your family’s advantage:

- Reflect.

What’s working as intended? What is out of date? What will change in the next generation? What’s keeping you up at night? Because these issues feel important but not urgent, they often simmer under the surface, creating stress and uncertainty. Writing everything down can be a good first step to seeing the whole picture and identifying the key issues that are likely to impact your family in the next few years.

- Get others involved.

Trusted family members, non-family employees, and advisors can have good insights into potential areas of focus and future risks and issues. And, engaging family members in learning, discussion, prioritization, and solutioning can build engagement and support for future direction. You can start simply with just a few key people, and over time, consider how to collect a broader set of viewpoints as you start to take action.

- Just get started.

The most common refrain we hear from families is: “We should have started sooner.” Whether your efforts are large or small, those first steps often create momentum for significant positive change. Families we work with often start with a concrete project, like a family employment policy or educating the next gen on trusts. When that is successful, everyone has more appetite to focus on the next idea.

Strengthening Your Family Advantage for the Future

Sustaining a thriving multi-generational family enterprise requires more than just legal documents or financial strategies. As families and businesses change, your family’s shared commitment remains your greatest competitive advantage.

To sustain and grow your Family Advantage for the future, invest today.

About the Author: Kristi Daeda is the president and CEO of The Family Business Consulting Group, leading the firm’s strategy, talent development, and operational platform, and serves as Dean of Family Business at the Purposeful Planning Institute, where she helps shape thought leadership on family enterprise topics.

Additional Resource

Choosing and Using Advisors: A Multidisciplinary Approach

The energy and commitment for success must come from your family. That said, building shared vision, structure, and family strength requires sustained attention that’s hard to maintain on your own. Plus, your family’s challenges are often novel and complex, requiring specialized expertise. The right advisors can help you keep the forward momentum you need, allowing you to focus on leading the enterprise.

Technical Advisors: Technical expertise is essential for estate planning, financial planning, insurance, transactions, and operations. While some expertise may exist within your enterprise, you’re often best served by specialty advisors with deep, relevant experience.

Family Business Advisors: Typically have technical expertise in one or more areas (business operations, leadership, family dynamics, finance, governance) and bring unique expertise in “connecting the dots” between various areas, seeing around corners for common risks and challenges, and helping the family engage together, building buy-in and momentum around important topics.

In the book, How to Choose and Use Advisors: Getting the Best Professional Family Business Advice, FBCG co-founders Craig Aronoff and John Ward highlighted some of the most important activities successful families focus on over time. These activities often focus on building stronger vision, structure, and family strength, and are often outside the scope of other advisory relationships.

Leveraging Family Business Advisors Through Each Stage of Growth

A critical consideration: Regardless of the type of advisor you are working with, select advisors who recognize the importance of connecting vision, structure, and family strength. The best advisors see how their contribution contributes to the whole, recognize the limitations of their own expertise, and actively collaborate with others to design solutions.

September 16, 2025