Money touches every aspect of our lives yet having discussions around financial matters is uncomfortable for families. Money matters present us with many paradoxes and contradictions that are both social and deeply personal.

When we reflect on the greatest challenges and conflicts business-owning families face, most of the deeply rooted relationship conflicts are embedded with a financial element. Some families dance around the financial discussions in an attempt to avoid them. Others approach them rather bluntly and unskillfully. Both polar approaches risk damaging family relationships and the harmony required for family business continuity. In this article, we provide guidance on how to have conscious, positive conversations about financial matters in a skillful way.

The Money Paradox

Money is never just about money. At its essence, money is closely tied to our relationships. In our relationship with others, it’s how we store and exchange value in society. In our relationship with ourselves, our individual experience of money is unique and deeply personal. It forms the degree to which we feel financially autonomous which impacts our self-esteem, confidence and sense of well-being. These relationships and experiences set the stage for discussions around money that often trigger negative, intense emotions like defensiveness, fear, resentment, shame or guilt.

Families are naturally financially interdependent. The degree of their reliance on one another depends on their stages of family development and their family culture. Financial matters that impact one family member tend to have “spill-over” effects that will impact other family members. While this is true for all families, it may be especially true for business-owning families where shared ownership of significant assets, performance of the business, personal income and lifestyle choices are tangled together. This financial interdependence mixed with the family’s interdependent roles not only impacts identity, rank, power and privilege, it also makes discussions around wealth and financial decisions potential landmines for conflict in business-owning families.

Money is Personal

Numbers are simple, but money is full of complexity and deeply personal. No two people have the exact same experiences of money in their lives. Siblings brought up in the same household will have different first jobs, develop different skills, have different friends, and have unique experiences making, saving and spending money.

Sometimes these experiences vary substantially within the same family. For example, older children may experience parents who struggled financially through the startup years of a business, whereas younger children in the same household experience growing up in a family where the business was more established. In their life view, parents had more disposable income and made fewer sacrifices for the survival and growth of the business. These unique experiences color our understanding and relationship with money, making it deeply personal and very emotional.

Every day, business-owning families encounter decisions involving money, including such matters as:

- Evaluating the performance of the business and its management

- Cash needed to grow the business

- Strategic direction of the business

- Determining areas in which to invest and grow the business or conversely, harvest or scale back, such as closing or selling a division

- Ownership transition planning and whether ownership continues in the family or the company is sold

- Retirement planning and liquidity needs of the current generation

- Income generation needs of the successor generation

- Fairness and equity in estate allocations to the next generation, particularly when some members may be employed by the company and others are not

- Philanthropic and entrepreneurial aspirations of the family as a whole and its members

Here are some ways that money shows up and can be a potential source of conflict in any one of the above conversations:

- Some family members have more financial experience and acumen then the others, creating a perceived shift in power and control

- Different risk tolerances between sibling owners or even between spouses

- One family member has a stronger sense of entitlement, given they were brought up in a different lifestyle

- A family member insists on a lifestyle that’s not sustainable with their ability to earn an income, independent of dividends from the business or gifts from the family.

- Trustee power exists over one another

- New money: A financial windfall occurs from a liquidity event and family members are ill-equipped to handle the monies in a disciplined manner

- Old money: Some family members may have shame of how the family historically made their money

- Inequities, real or perceived, that came from distributions, gifts or opportunities that presented themselves to one family member over another

- Suspicions and mistrust about how money was managed

Learning to Talk About Money

In our experience, there is one critical distinction of families that navigate these rough waters better than others: They refuse to avoid these conversations. They don’t just talk about money occasionally, they do it all the time. There is a shared commitment to build the communication skills required to navigate these financial conversations with skill and they nurture a learning culture to support their efforts.

We advise families to follow these guidelines while discussing finances and wealth:

Emotions are Contagious

Conversations unfold better when we start with a positive mental framework. When we enter the discussion with the frame of mind that conversations about money will end in conflict, chances are that it will be a self-fulfilling prophecy. Strive to engage in financial conversations with a positive, grounded frame of mind and commit to remaining so throughout the discussion.

Be Respectful

Being respectful of people’s needs to understand and have autonomy over their lives is important when it comes to financial decisions. Taking responsibility for others’ financial thinking and decision making can be debilitating in the long-run. It doesn’t build skill in the other person and can erode their confidence instead of build on it. In addition, resentment may fester in the individual carrying the heavier load and also in the person who feels left in the dark.

Financial Skills are the Survival Skills of Our Time

After a certain age, we are all responsible for our own survival — given our mental capacity allows for it. When we abdicate this to others who seem more capable, we cheat ourselves of learning important money skills and taking responsibility for our own financial well-being. Over time, this can be detrimental to our self-esteem and erode our sense of confidence and personal autonomy.

The Instinct to Protect May Backfire

Helping people learn life and money lessons with small stakes over time can prepare the rising generation for bigger decisions down the road. Learning to take responsibility for your own financial acumen and support others in their own financial literacy journey builds self-confidence and generates goodwill.

Further, when we believe that others have control over our finances, and when things don’t go as planned (and they often do not), we may be tempted to blame each other instead of learning about the thought processes that led to the decision and the assumptions that were made along the way.

Time-Pressured Decisions Deserve Heightened Communication

Financial decisions are often time-sensitive, but when people make decisions without our input, we can start to feel suspicion and resentment. In the absence of information, our brains fill in the gaps with defensive, self-preserving thoughts. The need to communicate the thought processes and the assumptions leading to the decision is even greater in time-pressured decisions.

Transparency and Trust

Research shows that we think that because someone is related us, we are automatically trusted by them. Often when parents think they know what’s best for their children, their children question whether the parent is steering them towards their own vision for the future. Lack of transparency and discussion about each parties’ intentions clouds both parties’ perspectives and makes it difficult to align priorities.

Approaching money conversations with sufficient transparency and adequate explanation reduces the amount of vulnerability that each person experiences. Transparency reduces the amount of fear (real or perceived) that may undermine the conversation and opens the door for greater trust.

Manage Communication Toxins

Communication toxins, such as criticism, defensiveness, contempt and stonewalling, can become rampant in discussion around money. To avoid breakdowns in relationships, be mindful of how these toxins can show up and use some of the strategies suggested in the Family Business Advisor article: “The Learning Family: How to Manage Communication Toxins in Family Relationships.”

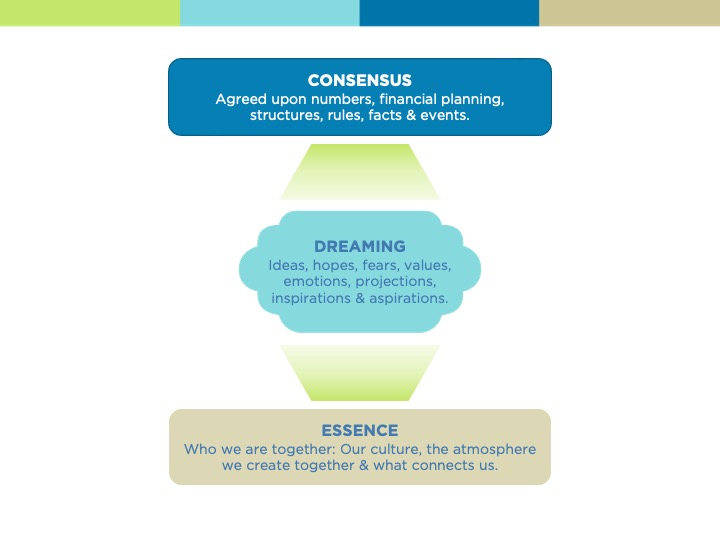

Uncover Your Family’s Levels of Reality

For relationships to be healthy and to ensure and strengthen shared understanding between family members, it’s important to consider that there are three levels of reality that powerfully influence all relationships: Essence, Dreaming and Consensus Reality. Discussions about money that address all three levels support individuals and the group to create shared meaning and understanding.

The three-level approach (figure 1) is based on a model developed by Amy and Arnold Mindell, experts in process psychology. Applying this model to family financial decision-making can improve our ability to communicate effectively, handle conflict in a positive way and motivate others. This framework advises that families ground themselves in appreciating and understanding who they are together. They need to be mindful and acknowledge the essence of what connects them and makes that group of individuals a family.

Then they need to dream together. Dreaming requires process and it’s wise to have a facilitated conversation that encourages individuals to share, especially when the stakes are high. Facilitated dreaming conversations create a shared understanding between individuals that is vastly different than when each person arrives at their own dream and attempts to advocate for it.

Magic happens when we engage in dreaming together. We create a new destination in our mind where we all traveled to safely and saw the same thing. This helps business-owning families develop the consensus reality of the future. A shared vision, through the three levels of reality, builds the framework necessary to understand the financial issues where agreement is needed, such as goals for growth, risk, profitability and liquidity.

When families are weak in one or more levels of this framework, it leads to conflict. When conflict arises, we should ask ourselves: Which areas we are the least skilled at? Are we honoring the three levels of reality? If not, how should we intentionally work to strengthen that skill?

Have the Conversation

When having important conversations about money in your family, ask yourself whether your conversations are honoring the importance of all three levels.

- Start by understanding and affirming your shared values.

- Allow for enough time to explore the dreaming together. Affirm the dream and build upon it in context of the matters at hand in the conversation.

- Share the strategic and financial assumptions and analysis of pros and cons to help everyone in the family system learn together and feel a part of the process.

To keep relationships healthy, a good rule of thumb is that when it comes to finance, the numbers are the consensus reality that we get to. It is not the place we start from. We always need to start from our family culture and core values then do the dreaming so that we know we can learn together and align on the numbers.

When it comes to money and the family business, there is no better investment than ongoing, effective communication. The payout is priceless.